This year, UOB is giving a birthday reward to the cardmembers. It is pretty interesting one. If you are one of them, you should really take a look.

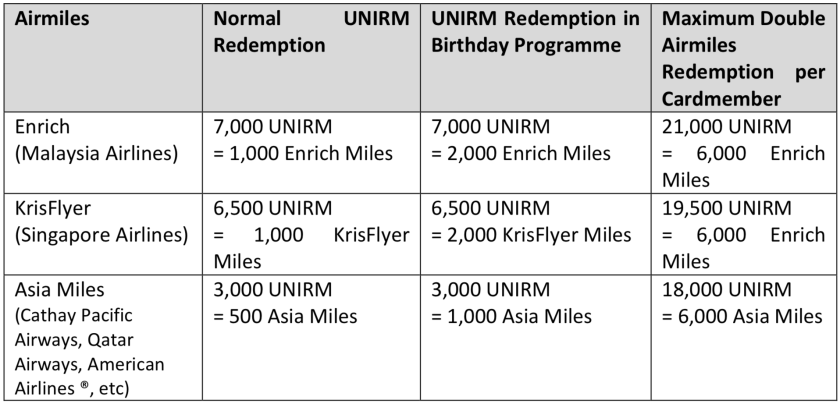

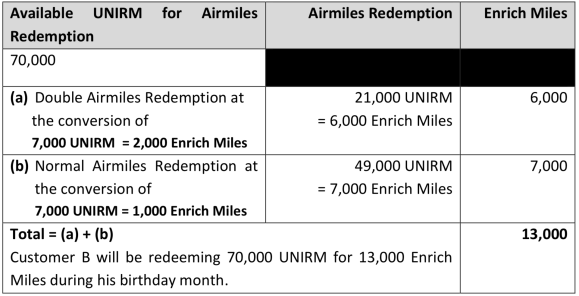

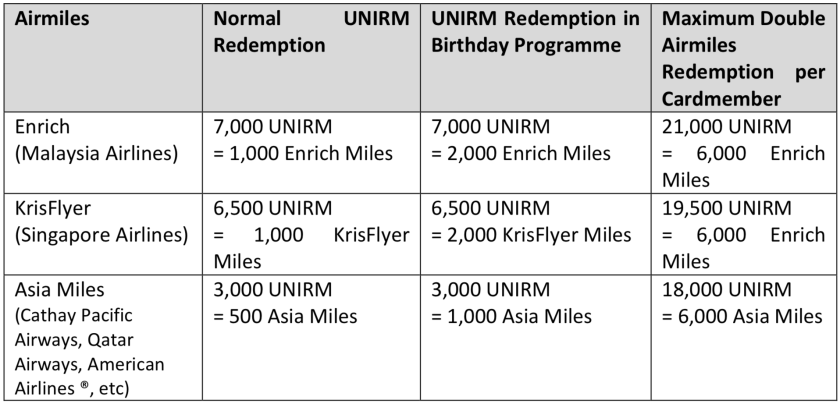

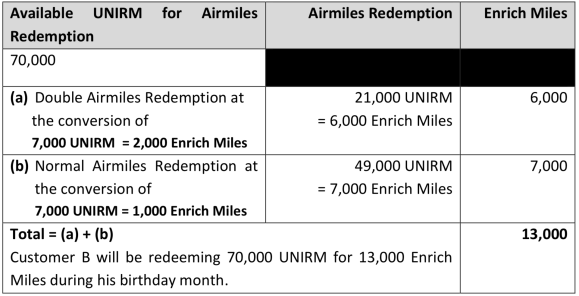

UOB is now offering Double Airmiles redemption on your birthday month. Though, it has a capping on this double redemption, limited to 6,000 airmiles.

If you wish to convert more, the remaining will be as normal redemption rate.

Let’s use Enrich Miles for calculation. If your spending is local, your conversion rate is halved from RM7/EM to RM3.50/EM. If your spending is in foreign currency (overseas or online purchase in foreign currency), your conversion is now halved from RM1.40/EM to RM0.70/EM.

So, if you are to compare with other cards:

| UOB V.I. birthday bonus |

: RM0.70/EM (forex) |

| HSBC Premier Travel |

: RM0.909/EM (forex) |

| MB2C Premier |

: RM0.954/EM (full 5xTP) |

| Ambank WMC |

: RM1.00/EM (5x, on overseas only) |

| HSBC Visa Platinum/ Signature |

: RM1.3125/EM (full 8x) |

| UOB V.I. (usual rate) |

: RM1.40/EM (forex) |

| HLB Sutera |

: RM1.67/EM (full 6x) |

| Citi Rewards Platinum/Signature |

: RM1.70/EM (full 5x) |

| HLB V.I. |

: RM1.80/EM (forex) |

| HSBC Visa Platinum/Signature |

: RM2.10/EM (full 5x) |

| MB2C Platinum/Gold |

: RM2.12/EM (full 5xTP) |

| Citi PremierMiles |

: RM2.25/EM (forex) |

| MB2C Premier |

: RM2.385/EM (2xTP, local) |

| HLB V.I. |

: RM2.80/EM (local) |

| HLB Sutera |

: RM3.34/EM (3x, dining/WKND) |

| HSBC Premier Travel |

: RM4.00/EM (local) |

| Citi PremierMiles |

: RM4.50/EM (local) |

Even though each of them has different conversion rate, but each of them have their strengths and weakness. We shall leave the comparison to other post.

If you are not spending much (or did not even bother) this card, perhaps, you can consider, spend it upto RM4,200 (if you are going for Enrich Miles, RM3,900 if KrisFlyer, RM3,600 if AsiaMiles) after currency conversion (be it overseas retail or online spending in foreign currency) before your birthday month.

Remember, you are to only able to get double redemption on your birthday month. If you spend on your birthday month to get enough points, you won’t have enough time to do the redemption. So, please take note.

Well, UOB is having a good move this year on this V.I. card’s Privilege. Hope they retain this as their another attractive benefits following after the free 4 or 6 entry/year to Plaza Premium Lounge. Even better by increasing the double redemption limit.